A question we get asked very often is—why do you even need investor updates? Think about it. Investor updates are not just incredibly useful tools for you as an entrepreneur but also for your investors.

These periodic updates are vital for building fruitful and trustworthy relationships with current—and even potential—investors. Additionally, investor updates also help in keeping track of your business by helping all stakeholders be aware of the strengths and weaknesses of its current situation.

Why should you send regular updates to your investors?

Consistently sending out these investor updates is a norm that most startups follow today. And regularly updating your investors comes with more pros than cons. There are quite a few upsides to sending out these emails, as you will discover through the course of this blog post. Here are a few of the most important reasons to update your investors often:

It keeps all parties accountable and engaged in the process

Probably the primary—and most obvious—reason to shoot these updates out consistently, is transparency. Updates keep everyone actively engaged in the development of the company and accountable for the advances and failures. It thus shows transparency with your stakeholders.

Keeping track of the business progress and the difficulties that arise over a while is an excellent opportunity to look for solutions and recommendations together, actively.

Your company stays on top of the mind

A cardinal rule is that investors, such as venture capitalists and angel investors, have to oversee other companies they have invested in as well. If they don't receive regular updates from you and your startup, they will likely focus their efforts on other projects. They would rather spend their time and effort on projects that show great results and are actively asking for help in some areas.

You must keep their interest levels high, not only for your current operations but also for the possibility of opting for additional funding from them in the future. And the perfect way to keep them engaged is with regular investor updates.

Shows transparency and builds trust

Having good investor relations is potentially as important as maintaining a good relationship with your clients. Why? Because your investors are not only providers of funding, but they can also supply you with advice and assist you during the several difficulties you may encounter in your journey.

By sending them regular updates on your startup’s progress, you show that you're being transparent with them and create a trusting and meaningful relationship. In turn, this allows you to have an open channel for honest feedback.

Potentiate future relationships with other investors

Having a trusting relationship with your existing investors is usually taken as a positive sign by other VCs and angel investors. They look at this as a positive while considering an interest in funding your project. A good, healthy relationship with your investors may even present you with recommendations to other investors.

Your updates can become a sort of pitch deck for potential investors that are debating whether to fund your startup or not. This is also an excellent opportunity to show them how your company has developed over time and how consistent it is with making progress.

This record of your company's headway can be a tool for founders to nurture relationships that may eventually evolve into funding and further opportunities.

Investors deserve to know the fruits of their investments

Besides these obvious purposes, it’s important to remember that investors simply deserve to know what’s going on in the startups they have placed their resources in.

They have trusted you and your project by investing their capital into it, and it’s only fair to return this trust by keeping them informed about the results of their investments.

How often should you update investors?

Although there aren’t any fixed requirements—and it generally depends on the investor's preferences—we recommend updating your investors at least once every quarter.

You can choose to send these updates on a more regular basis, like monthly, if you consider them adequate based on your company’s situation, development rate, and new advances. However, keep an open channel with your investors and try to find out their preferences regarding the frequency of these communications.

If the final decision is to send the updates on a quarterly basis, we advise sending these emails out near the end of the quarter.

By that time, you will probably have a more accurate idea of the state of affairs of the business. You will also be able to accurately portray:

- Your current situation,

- The struggles you may have been dealing with so far,

- Your accomplishments, and

- The areas where you require more help.

Do investors ask for monthly updates?

Depending on the investor, the type of business, or which market you are operating in, you may be requested to send monthly investor updates. However, we recommend not waiting to be asked, but instead, being proactive and asking your investor their preferences.

If you finally do decide to send monthly updates, you should try to make it work in your favor. Try to make every update count, using the opportunity to ask for your investors' advice, recommendations based on the situation you have portrayed, referrals, and more.

Whatever frequency you choose, keep in mind that the most important thing with regard to investor updates is being consistent. If you've chosen to send out monthly updates, try to stick to a date towards the end of the month or the beginning of the new month. If you're working on sending out updates on a quarterly basis, try to send them towards the end of the period, and continue to stick to the schedule.

Want to learn more about the basics of writing effective investor updates? Sketchnote has a primer for you.

Tips for sending regular investor updates

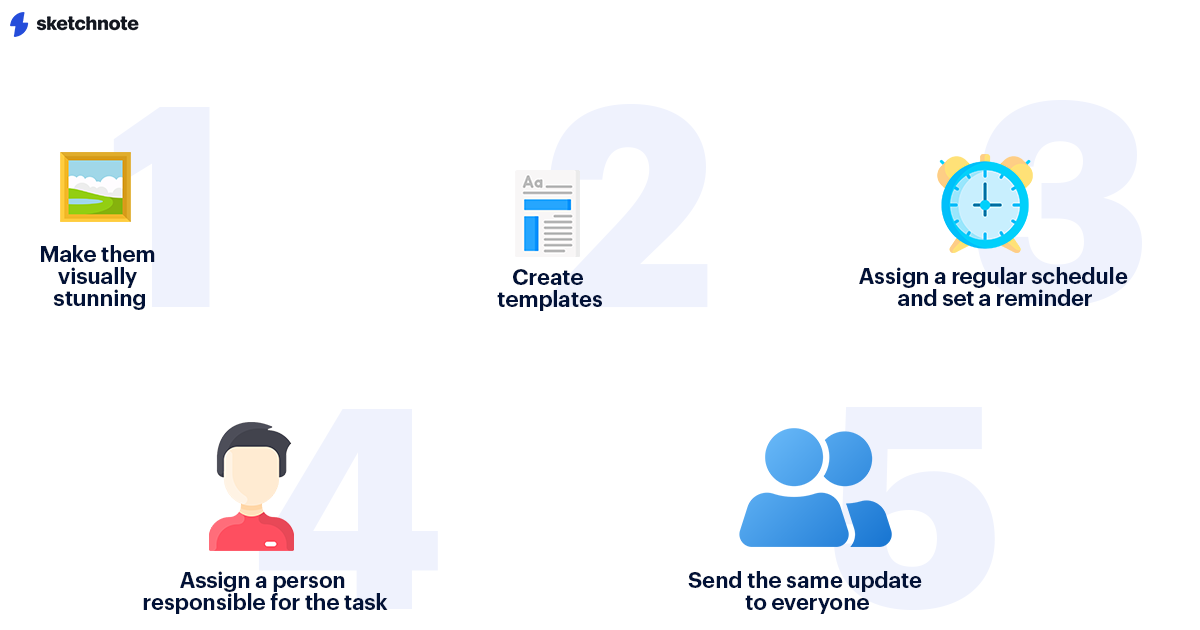

Make it visually appealing

Investors receive a fair amount of updates from the various companies that they fund, on a regular basis. While many send these quarterly, investors also get a few monthly updates.

This can get somewhat overwhelming and lead to losing the ability to focus entirely on every detail of every update they read. And it's understandable given the volume of emails that they get.

In order to truly stand out and make an impression on the investors' mind, try to make your update visually easy to follow. Better-presented updates circumvent mental fatigue and help whoever is reading your update concentrate better.

A visually striking and easy-to-follow investor update incorporates elements like images, a set color palette, good fonts, relevant links, and more. It’s also essential to ensure you use an adequate format for your company.

You can create and send out your update as a letter, a PowerPoint presentation, in the mail body, or as a Word document. However, you can also check out Sketchnote's investor update template which will allow you to create an investor update within minutes!

Create templates

As you work on your investor updates (even on Sketchnote) you can create a company template and save it. The person responsible for creating this update will only have to worry about filling in the gaps and making sure all the important information is accounted for, every month or quarter.

This, obviously, makes short work of making and sending out investor updates, and also keeps a structure in place for it.

On Sketchnote, you can even prepare your own investor update template and reuse it with one click by saving it in your organization!

Assign a regular schedule and set a reminder

At this point, we know that sending investor updates has to be a regular practice. However, it’s important to set a specific date on which the update will be sent and not use broad deadlines such as "the last week of the month" since this can cause confusion and delays.

Establish a specific day and set a reminder to dispatch your updates on time. This will help you seem more reliable, dedicated, and punctual.

Assign someone responsible for this task

Founders are the ones in contact with investors pretty much most of the time. They're also responsible for nourishing and caring for their relationships with said investors. Therefore, it only makes sense that they are also the party to send these regular updates, sticking up for the wins and losses of the company.

However, many startups have more than one founder. In this case, it’s recommended you assign a singular individual to be the one responsible for this task, permanently. This way, the company can avoid misunderstandings such as thinking that someone else sent the update, sending them twice, and more.

Send the same update to everyone

If your startup has more than one investor, you can send the same update with all the important general details to all of them.

However, you should always offer to give extra information if any of them want to know anything more specific. With Sketchnote's files, you can also set your updates to the public, password-protect the file and send your report to your investors, for their eyes only. This way, all of them receive the same information, and you don't have to worry about attaching files to your emails.

In conclusion, having regular and consistent communication with your investors can bring your company a multitude of benefits. Entrepreneurs should make use of this opportunity, and we hope that by following the previous recommendations you will be able to use investor updates to their full potential. Good luck!