Southeast Asia's startup landscape has witnessed an incredible boom over the past few years. With big guys like Grab, Bukalapak, or GoTo paving the way, a new wave of even more prepared founders has entered the startup scene.

In 2021, the region's startups received $25.7 Billion in funding, up from $9.4 Billion raised in the previous year. And the regional tech boom shows no signs of abating. According to a report conducted by Google, Temasek, and Bain & Company, Southeast Asia's Internet economy is set to reach $360 billion by 2025.

This maturing ecosystem has attracted investors following the footsteps of the more established VCs— venerable names like Insignia, East Ventures, Monkshill and Openspace. These guys made their big bucks betting early on the likes of Gojek, Tokopedia and Ninjavan… and gradually moved up the value chain from Seed to Series A, as their fund size -and minimum tickets- have gotten bigger and bigger.

It's no surprise that new players have entered the Seed funding scene- including venture builders and micro-VCs—who are keen to fill in the vacuum for smaller check-sizes of up to $500k.

What exactly is Seed funding?

The Seed-stage funding scene has changed over the years. According to Investopedia, seed capital “refers to the type of financing used in the formation of a startup. Funding is provided by private investors—usually in exchange for an equity stake in the company or for a share in the profits of a product.”

However, these days the larger Seed VC funds typically wait until startups have enough traction before investing. That's why many founders look to angel investors and pre-seed VCs to secure their first check.

It can get confusing with all the terminology: pre-seed, seed, pre-series A... For clarity's sake, these three categories can be defined as early-stage. Basically, early stage VCs provide money to support the business until it finds and validates product-market fit.

Some early stage VCs focus on one specific segment, while others cover the whole spectrum of early stage startups.

Which VCs are filling the early stage gap in SEA?

If you're an early stage founder in Southeast Asia looking to get funded, your basic choices are angel investors, crowdfunding platforms or VC funding. For those who are ready for it, VC money can help founders turbo-charge their journey.

If you feel there's a founder-investor fit with VCs, here is a selection of early stage funds active in Southeast Asia's ecosystem:

Antler Indonesia

Founded in 2017, Antler is a global early-stage VC investing in startups all over Europe, North America, Asia Pacific, and Africa.

With more than 400 startups funded and over 500 advisors globally, Antler affords a great deal of support and opportunities to entrepreneurs in Southeast Asia.

Antler’s primary operating sector is Digital Enablers. The businesses have a great scope of sectors such as AI/Machine learning, Business Solutions Platforms, E-Commerce, Food and Agri-Tech, Gaming and E-Sports, Healthtech, Media and Communications, Mobility, and SaaS.

Antler has been the name behind funding received by several successful startups such as Base, Sampingan, Xailient, FusedBone, Eateroo, Path BioAnalytics, Airalo, Breathonix, and Brick.

PT Prasetia Dwidharma

Prasetia Dwidharma is Indonesia's premier B2B-focused investor. Twin brothers Arya and Ardi Setiadharma have been funding startups since 2016, at the height of the B2C boom. At that time it made more sense to pay attention to overlooked early-stage B2B startups.

From industries like Fintech to SaaS, its portfolio includes successful businesses such as Qontak.com, Cakap and Brick.

It is currently operating across Southeast Asia, mainly in Indonesia, but also in Malaysia and Singapore.

1982 Ventures

1982 Ventures is the first early-stage VC that exclusively funds local Fintech entrepreneurs from Southeast Asia, in its journey to support the businesses that will become “the backbone of Southeast Asia’s new economy.”

Their portfolio includes successful businesses such as Wagely, PasarMikro, and Monit.

500 Startups

A global leader in VC Funds, 500 Startups has more than 2,600 startups worldwide backed up by its investments. Forty-five of its startups have reached a $1B value, and more than 130 companies have already reached the $100 million value mark.

Its branch, 500 Southeast Asia, has supported more than 240 companies from different sectors such as Biotech, Marketing, Realstate, or eCommerce. It currently operates in more than 8 Southeast Asian countries, predominantly in Indonesia, Malaysia, and Singapore.

This VC's portfolio includes outstanding businesses such as Canva and Credit Karma and local hits such as Grab, Bukalapak, and Carousell.

SOSV

This VC is a globally operating firm that focuses on new technologies in hardware and bioengineering that “promise the betterment of humanity and the planet”, as well as on Asia’s cross-border consumer and enterprises markets, which are now booming.

SOSV has offices in Shenzhen, Shanghai, and Taipei, and holds a portfolio of more than 1000 companies, such as Yeelight, Snapask, BitMex, and API3.

Plug and Play SEA

Plug and Play Asia Pacific started its activities in 2010, focusing on investing in high-tech startups from more than 18 industries all over the Southeast Asian area.

This branch’s headquarters are currently located in Singapore, although they also operate in countries like Indonesia, Thailand, the Philippines, and more.

This is one of the most recognized Venture Capital firms in the world. Among their most notable investments are Paypal, DropBox, Honey, N26, and Zoosk.

Draper Startup House

Draper Startup House has a strong presence in several countries all over the world. It bases its activities on the idea of connecting entrepreneurship and Venture Capitalists, Angel Investors, and Suppliers to empower businesses and drive progress and growth.

Draper Startup House has a huge presence in Southeast Asia, including centres in Malaysia, Indonesia, Cambodia, Vietnam, the Philippines, and Singapore, among others.

Hybrid, Ferne, and Intribe are just a few examples of the success stories you can find in their portfolio.

Global Founders Capital

Global Founders Capital is an international investment company focused on both seed and growth funding, with an impressive portfolio of successful startups.

With worldwide renowned businesses such as Zalando, Trivago, Slack, Facebook, LinkedIn, Skyscanner, and HelloFresh in their books, Global Founders Capital has established itself as one of the top VC firms globally.

Out of its 18 offices, three are in Southeast Asia, specifically in China, Indonesia, and Singapore.

Foxmont Capital Partners

Foxmont Capital Partners is an independent VC that focuses on investing in Filipino early-stage technology startups.

Since its origins in 2018, Foxmont Capital's portfolio has grown exponentially, with successful investments such as Kumu, Podcast Network Asia, Edamama, and MedHyve.

Sketchnote Partners

Sketchnote Partners invests in early stage startups across Asia with a founder-first focus. Founded in 2021, Sketchnote.co's venture arm invests in exceptional founders building products showing early signs of product-market fit.

Sketchnote Partners' portfolio includes Shipmates (Philippines), Zaapi (Thailand), KaryaKarsa (Indonesia), JiPay (Singapore), Aplus Homes (Vietnam), Armada Brands (Philippines) and PasarMikro (Indonesia).

AC Ventures

AC Ventures is a tech-focused firm that was created through a merger of Agaeti Venture Capital and Convergence Ventures, two of Indonesia's leading VC funds. The fund concentrates on investing in early stage high-growth businesses.

With notable names in its portfolio, like Beam, Shipper, Aruna, Ula and more, AC Ventures positions itself as a founder-first venture capital fund, building networks across Indonesia and Southeast Asia.

Partech Partners

Partech is a France-based investment platform that focuses on funding innovative tech and digital startups from various sectors, ranging from software and services to deep tech.

Since its beginnings in 1982, it has grown to invest in projects based in over 38 countries, building a portfolio of more than 200 companies. In Asia, it has funded and supported successful businesses such as Beam, Igloo, Zaapi, Homebase, and Kyash.

Besides the above-mentioned startups, there are some more stellar Seed Funds that have been doing a standout job with Southeast Asian startups. Here are a few of them:

- Gobi Partners

- Monkshill Ventures

- Indogen Capital

- Amand Ventures

- Azure Ventures

- GoVentures

- Vina Capital Ventures

- Betatron

- CoffeeVC

- Kejora Capital

- Golden Gate Ventures

- Pegasus Ventures

- Insignia Venture Partners

- 335 Fund

- January Capital

- Alpha JWC

- Jungle Ventures

- Ratio Ventures

But, how can you choose the right VC?

When you're an early-stage startup, any offer of investment you receive will sound heaven-sent. It's a no-brainer for many to say yes almost immediately when you're offered the funds you so badly need.

However, accepting an offer without considering the founder-investor fit can be a problem at a later stage. So much so that it can sabotage the possibilities of the startup actually succeeding.

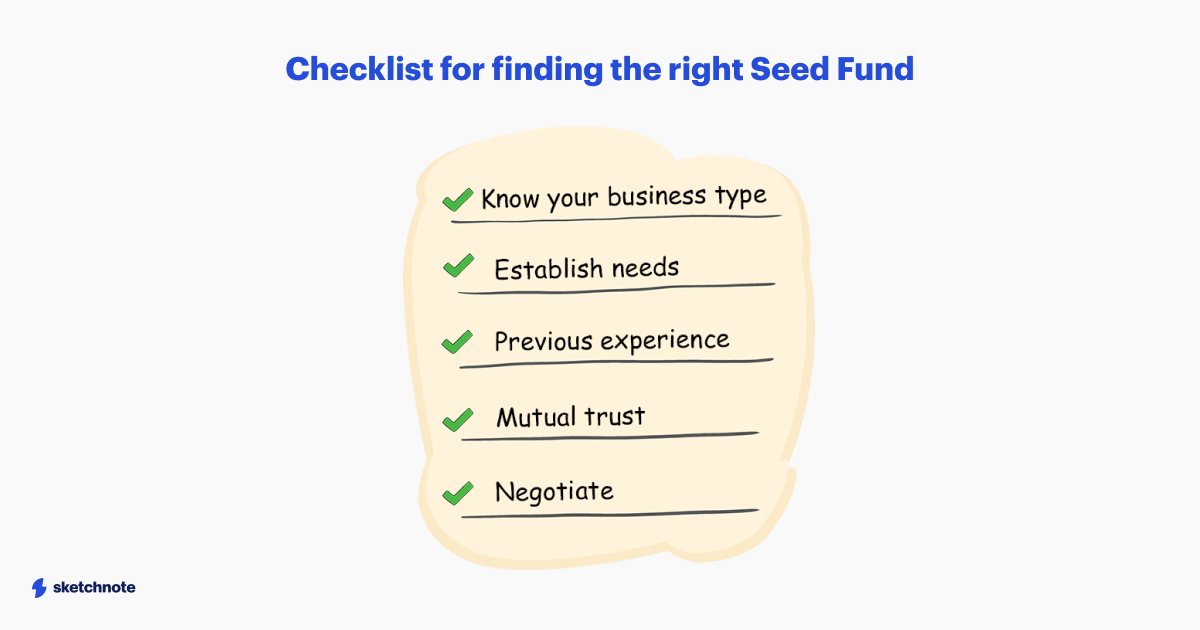

Not every type of investor is going to be a good fit for your startup. Founders: it pays to consider the following five points before making your choice:

1. Know your business type

Think about your own sector before you zero in on an investor. If you're in a regulated sector like fintech, or healthtech, why not reach out to specialized investors? They will be able to help you with licensing clearance and valuable connections.

When choosing, look for an investor whose interests are aligned with yours, and who understands your business model. The support you can receive won't be exclusively monetary but also in terms of guidance and support.

2. Establish your needs

By the time you start looking for different investment options, you should have a clear goal and know exactly what your capital requirements are.

If you have not established and secured your financing goals by the time you start speaking with VCs, it will not look very serious.

3. Previous experience

Have the startups the VC has previously invested in been successful?

Look at its track record, research, and analyze how others in your position have evolved with its support. This can help you understand a lot about how the VC manages its investments and the future of the startups under its wings.

4. Mutual trust

Your investors are going to be by your side during a significant part of your startup journey.

It is crucial that they have trust in your idea and share your vision for the future. So when tough times come by, you know they're not going to abandon you.

Schedule interviews with all the investors that align with your requirements, and don't be afraid to ask questions. Make sure that you know the reason why this VC is more valuable to you than the rest, and make your choice mindfully.

5. Negotiate

If you're going for VC money, don't settle for the first VC check that you'll receive. It's best to get a few offers from different VCs in order to get the best terms possible. You may be able to get a more advantageous valuation for your startup as well.

To do this effectively, it's best to get a bunch of back-to-back meetings lined up beforehand. This will enable you, as a founder, to get auction-like conditions. The alternative is to organize meetings in a linear fashion. You will not be able to get the benefit of competition in the same way, but you will get feedback that might be useful for the next investor meeting.

Either way, while encouraging competition is good, don't get greedy. The point is to get the best possible terms from the VC that is most aligned with you. It's better to take a check from someone that will accompany along your entire journey, than focusing only on valuation.

Remember, this decision will significantly impact the future of your startup since the relationship you develop with your investor can provide an immense amount of value. Good luck!