The startup landscape in India is growing at a breakneck speed. According to the Government of India, India has the third-largest startup ecosystem in the world, with a year-on-year growth rate of 15% since 2018. It's safe to say that the country has become a global startup hub now.

And while ease of doing business has been on the government's mind since the launch of the Make in India campaign, there are certain legal requirements every startup in the country must comply with. These compliances are important to function legally, and startups need to beware of trying to push off dealing with these requirements for later stages of the business.

Why do you need to adhere to compliances, and what happens if you don’t?

Business compliance refers to a company adhering to all the regulations and laws of the land while managing all different aspects and actors involved in their business activity.

The biggest need for sticking to this requirement is to avoid criminal charges such as penalties, or even the possibility of imprisonment for entrepreneurs responsible for business activities. Besides getting into trouble with the law, facing constant charges for non-compliance can cause the company's public image to take a beating. It can also lead your core customer base to start believing your product and startup as being deceptive and fraudulent.

Complying with internal requirements such as minimum wages, maternity leave, employee protection, etc., also simultaneously impacts the employees' satisfaction and well-being, thus improving the company's overall productivity. This can become a great asset for a firm trying to secure its workers.

What are the required compliances according to regulatory bodies?

To compete in a specific market, companies need to abide by the law of the country they are based in. And it's always best to start at the very first step with registering and incorporating your startup the right way. Compliance is a matter of habit—the sooner you start adhering to it, the better you get into the mindset of sticking to it at every step.

So in this article, let's get into further detail about the must-known requirements of the legal system supporting this booming startup ecosystem in India:

1. Choose what type of business you want to establish

In India, there are several structures you can choose to register as. Depending on whether you wish to found your startup as a Private Limited Company or an LLP or a Partnership, the different rules and regulations will vary. Once you work towards registering your company, you must keep a list of compliances handy so your adherence schedule and timetable don't go awry. These are the different recognized types of businesses you can establish, and the corresponding set of rules you need to follow:

- One Person Company - Companies Act, 2013.

- Private Limited Company - Companies Act, 2013.

- Partnership Firm - Partnership Act, 1932.

- Limited Liability Partnership - Limited Liability Partnership Act, 2008.

2. Register your Startup

Once the type of business structure you wish to establish has been locked in, it's time to register yourself as a legitimate business. Be warned that the procedure to register your organization will vary depending on the choice you've previously made. You may need professional assistance in order to ease the process.

2.2 Registering with Startup India

The Startup India Initiative is an initiative by the Indian Government to support its entrepreneurs. This is an excellent choice for all new startups trying to get into this thriving market. You can be recognized as a startup by the Department for Promotion and Industry and Internal Trade (DPIIT) by simply registering online.

The platform is looking to promote innovation in the country, allowing companies to access several incentives and economic benefits such as tax exemptions, all in order to boost businesses.

Read more about this initiative in our article about the Sartup India registration process.

3. Licenses specific to your business sector

Once you have registered your startup, it's time to look at compliances that are specific and applicable only to the activity they are carrying out. Let's take an example here. Say your business is a restaurant. Besides having to register yourself as one, you will also need licenses such as the Food Safety License or the Prevention of Food Adulteration Law. This is something a retail store, selling clothes, won't need.

The important thing to know about these licenses is that they're mandatory and what allows businesses to operate legally. If a company fails to obtain these licenses, required to run a company in their sector, it can be liable to face legal sanctions, penalties, or fines.

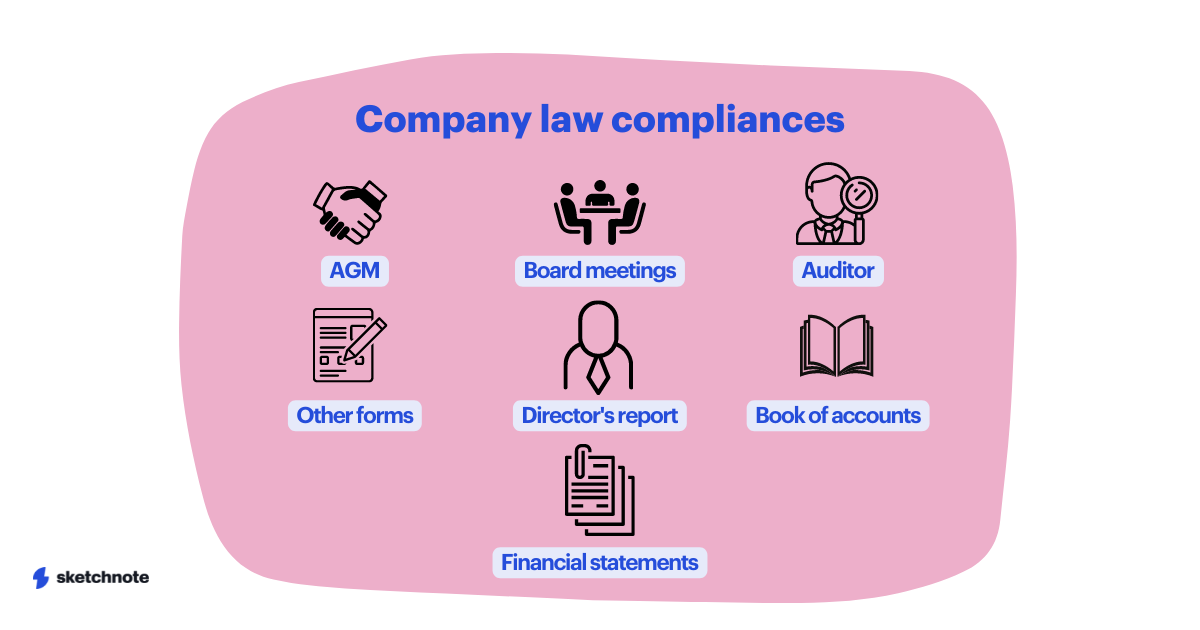

4. Company-law compliances

The next set of compliances that a registered company must follow is concerned with meetings with board members, filling of important forms, auditing information and creating reports. Here's a breakdown of these mandatory compliances:

4.1 Annual General Meeting (AGM)

It’s a mandatory meeting of the stakeholders that have to be held once a year, within six months of the financial year’s closing, and can’t exceed 15 months between meetings. However, the first AGM must be held within nine months from the conclusion of the first financial year.

The session's agenda will cover points such as the approval of financial statements, the appointment of auditors, declaration of dividends, etc.

4.2 Board meetings

The first of these meetings must take place within 30 days of the company's establishment. There should be four meetings every financial year that should take place no more than 120 days (3 months) between each other.

At least two directors, or 1/3rd of the total number of directors, should be in attendance at these board meetings.

4.3 Appointment of Auditor

Within 30 days of the company’s incorporation in the first board meeting, the first statutory auditor of the company should be appointed.

The company auditor will finalize the annual accounts and make sure that the organization is providing accurate details of its financial status.

The succeeding auditors would be established in an AGM and could be appointed for up to five years, although it should be approved by the stakeholders every year in AGM. The applicant has to file the ADT-1 form for a 5-year appointment.

4.4 Other Mandatory Forms/E-Forms Filing Requirements

- E-form: INC-20A (Declaration for commencement of business)

- E-form: AOC-4 (Financial statements)

- E-form: MGT-7A (Annual Returns for Small Company/OPC)

- E-form: DIR-12 (Appointment/Resignation of Directors)

- E-form: DIR – 3 KYC (Director KYC submission)

- E-form: MGT 14 (Filing of resolution with MCA)

- E-form: DPT-3 (Return of Deposits)

4.5 Directors’ Report

All companies are required to prepare a board report with all the information required under Section 134, with all the details regarding the company's condition, operations during the financial year, dividend declaration, net profit, corporate social responsibility standards, etc.

4.6 Maintenance of Statutory Registers and Books of Accounts

There are specific registers and records that every company must keep regular track of to ensure that the business is functioning systematically and efficiently.

These are the registers established as mandatory for companies to demonstrate the state of their affairs:

- Register of the Company

- Register of Members

- Register of Directors and Key Managerial Personnel

- Register of Charges

- Register of Renewed and Duplicate Share Certificates

- Register of Employee Stock Options

- Register of Shares/Other Securities Bought Back

- Statutory Books: referring to the specific records of shareholders, managers, and meetings held by the company.

4.7 Circulation of Financial Statement & other relevant documents

The Financial Statement is an annual document approved by the auditor of the company that is meant to inform the stakeholders about the company's financial situation. With this information about the business performance, the stakeholders can ponder whether to invest more in the startup or not.

This document should be sent along with the Director’s Report and the Auditor’s Report at least 21 days before the Annual General Meeting.

5. Taxation Compliances

These are the tax-related compliances that must be followed:

- Filing Income Tax Returns, Tax Audit Reports, TDS Returns, and Assessment of Tax Liability - Income Tax Act, 1961.

- Registration of establishment under the GST Act and filing monthly, quarterly and annual returns - GST Act, 2017.

5.1 Exemptions:

In their beginnings, startups in India can access some privileges in order to boost their growth:

- LTCG - Exemption from tax on long-term capital gains.

Under Section 54EE of the Income Tax Act, startups can be exempt from the LTCG Tax if the long-term capital gains invested are part of the fund notified to the Government within six months from the initial transfer date.

Other conditions should be met, such as the investment not surpassing Rs. 50 lakhs.

- Exemption from tax on investments above their fair market value.

The Government accepts the exemption of taxes for eligible startups on investments above the fair market value, including investments done by resident angel investors, family, or funds that are not Venture Capital funds.

- Exemption from tax for individuals/ HUF on LTCG from equity shareholding.

This act allows the exemption from tax on long-term capital gains on the sale of a residential property only if those earnings are invested in the small or medium enterprises (defined under the Micro, Small and Medium Enterprises Act, 2006) or suitable start-ups.

This means that an individual or HUF could apply for this exemption if it sells a residential property and invests that capital gained to subscribe to an eligible startup's 50% or more equity shares.

There is a 5-year period (from the acquisition date) in which the share can’t be sold or transferred to be qualified for the tax exemption.

- Three-year tax holiday within the first ten years.

Under section 80IAC of the Income Tax Act, any startup incorporated after April 1st, 2016, can avail of a 100% tax rebate on its profits for three years out of the first ten years (beginning from the year of incorporation).

However, if the company’s annual turnover exceeds Rs 100 Crore, the tax rebate won’t be available.

Only a Private Limited Company or Limited Liability Partnership can apply for this exemption.

6. Intellectual Property Rights (IPR) Compliances

Startups base a significant part of their success on innovation, creativity, and individuality.

They create a business that aims to bring something new to the world, a product, a service, a process. It is crucial for startups to protect the Intellectual Property Rights involved in developing their business.

There are several actions startups can take to protect these assets, like non-disclosure agreements, Copyrights, Trademarks, or patents.

One helpful tool for this is the Start-ups Intellectual Property Protection (SIPP) launched by the Indian Government, which facilitates the legal registration process of these assets through registered facilitators in IP offices by only paying the statutory fees.

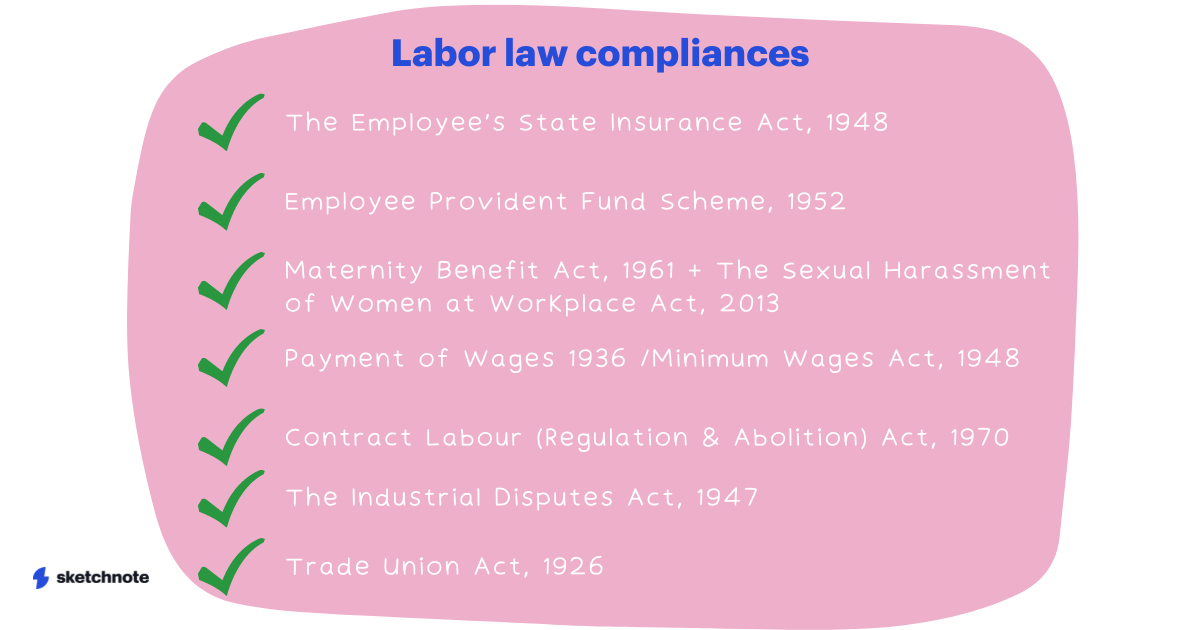

7. Labor-laws Compliances

Startups have to comply with the legalities of labor that come with becoming an active business.

These laws are meant to protect workers against the potential abuse of their employers, with regulations such as the Minimum Wage, Maternity Leave, or Protection Against Sexual Harassment in the Workplace. They are also an instrument to keep both parties accountable for their actions.

Some important laws that must be followed are:

- The Employee’s State Insurance Act, 1948.

- Employee Provident Fund Scheme, 1952.

- Maternity Benefit Act, 1961. This includes the obligation to comply with The Sexual Harassment of Women at Workplace (Prevention, Prohibition, and Redressal) Act, 2013.

- Payment of Wages 1936 /Minimum Wages Act, 1948.

- Contract Labour (Regulation & Abolition) Act, 1970, and Interstate Migrant Workmen (Regulation of Employment And Conditions of Service) Act, 1979.

- The Industrial Disputes Act, 1947 (a.k.a “ID Act”).

- Trade Union Act, 1926.

8. Compliances of Contractual Obligations

Every business has contracts that ensure the adherence to several agreements between actors involved in the functioning of the company, such as clients, employees, or vendors.

These agreements are documented and formalized in legally-binding contracts that both parties must follow.

Establishing contracts, for example, Non-Disclosure agreements, is also a great way to avoid future scenarios where the business can be compromised.

9. Event-Based Compliances

Event-Based Compliances are usually one-time requirements that happen as a result of a specific change, such as a change of director, a new registered office address, etc.

The Government of India has established that the following event-based Compliances must be notified and registered by private limited companies:

- Change in registered office address, INC-22 Form.

- Change in director or KMP, DIR-12 Form.

- Alteration in share capital, SH-7 Form.

- Filing of resolutions and agreements, MGT-14 Form.

- Allotment of shares, PAS-3 Form.

- Conversion of private limited company into a public company, INC-27 Form.

- Intimation of change in particulars of director, DIR-6 Form.

- Return of Deposit, DPT-3 Form.

Companies must meet deadlines to avoid penalties.

In conclusion, there are many laws and regulations to be followed, and it can get a bit overwhelming. However, it’s essential to make sure that your startup complies with them in its early days to ensure that the business will run smoothly and systemically.

We hope this article has cleared many doubts, although we advise you to look for professional legal help to assist you in this process and avoid mistakes.