Bad news for entrepreneurs. If you thought 2022 was rough, get ready for an even rougher 2023. The dirty little secret of venture capital is that many funds feel foolish for having deployed capital too quickly during 2020/21 and having paid expensive multiples on top of that.

Now that the Fed has raised rates, and risk assets are less in demand, VC Funds themselves will have a harder time raising capital from LPs. Consequently, they will spend the dry powder they have more slowly, and judiciously. This means that ridiculous valuations are—mostly—a thing of the past. Although FOMO is a hard-wired human bias, so specific cases of collective madness among investors are occasionally going to pop up.

From FOMO to JOMO

PitchBook and other credible sources have pointed out the record levels of dry powder. However, these will be of little help when VC Funds are licking their wounds, tending to their existing portcos, or just simply enjoying the opposite feeling of FOMO. That feeling is called JOMO, or the “joy of missing out”.

Alas, investors are all too human. Therefore, sanity is found between bouts of extreme behaviour. We have gone from FOMO to JOMO. Now founders need to wait for a slow return to normalcy. What is normalcy? It's the market condition that happens right after a bear market, and just before a raging bull market is reborn.

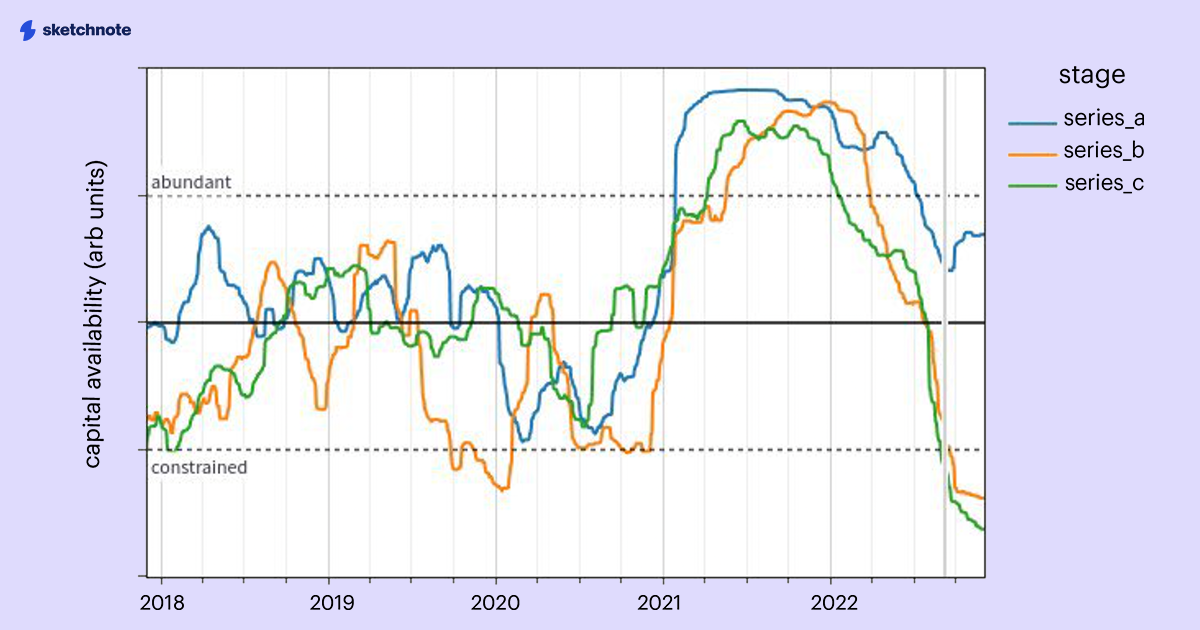

Early-stage conditions have stabilized

There is good news if you are an early-stage entrepreneur at a pre-seed or seed stage, you have less to worry about, compared to your brethren in Series B or C stages. Early-stage founders still have a ways to go before their product matures and they achieve scale. By that time—assuming 24+ months down the line—macro conditions will have eased, assuming we don't get invaded by aliens or dinosaurs cloned in a US military lab!

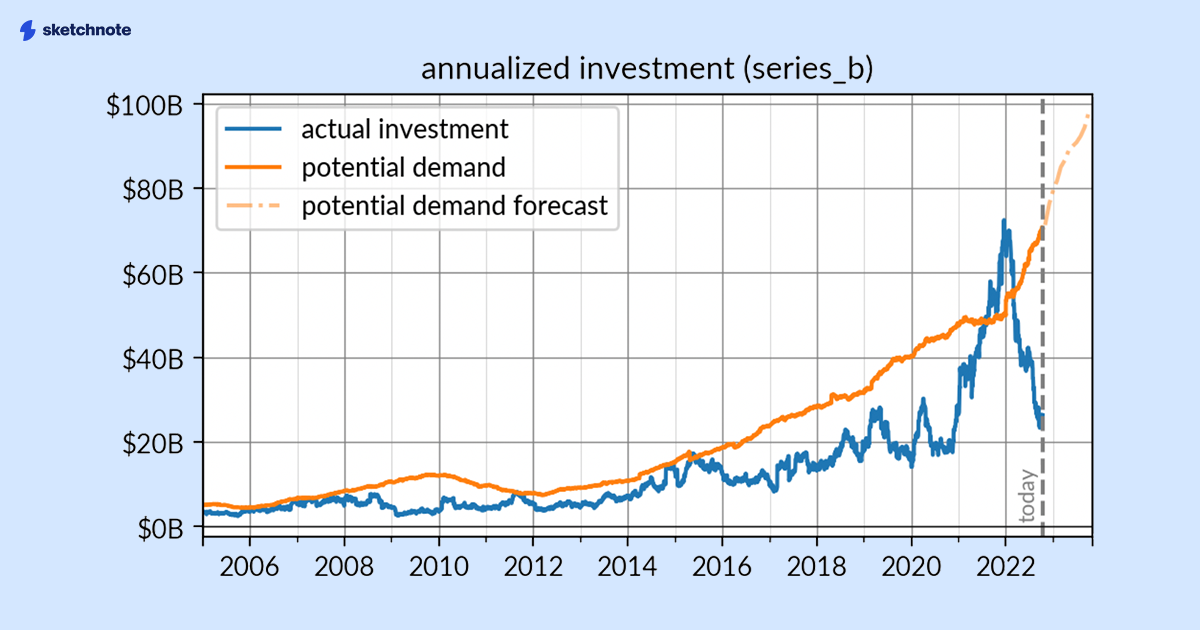

No money for Series B and C

Series B and C folks, however, have it the worst. As illustrated in the image above, Arjun Sethi from Tribe Capital has quantified the specific shortage of capital hitting intermediate venture stages B and C as $45 billion. This is the result of subtracting the $25 billion actually available as investment, from the $70 billion in latent demand for funding. And this gap will only increase in 2023 when demand for Series B investment will reach $100 billion.

This means that a lot of early-stage startups that raised capital in 2020-21 at rich valuations, will have a hard time surviving. Even if they reach product market fit. What happened—in the euphoric pandemic period when capital was cheaply and readily available—was that demand for venture investments greatly exceeded the supply of startups, and so valuations went through the roof. However, as capital is in short supply, conditions for investing in Series A and above have become more stringent, while revenue multiples have compressed significantly.

What this means for founders

Bubbly markets are a boon for confident founders who know how to pitch to investors. And even for those who know how to burn money in order to grow at all costs. These kind of founders flourished in 2020/21. However, the kind of founder who is likely to excel in the current challenging conditions is made of a different mettle. Indeed, this environment favors survivors who know how to execute ruthlessly while operating frugally. Smooth seas do not make good sailors, so now we shall see which startup captains thrive while steering their ship to harbour.

Adversity leads to opportunity

Luckily, skilled early-stage founders can continue to access capital from experienced VCs and opportunistic investors. As famous angel investor Fabrice Grinda puts it, while we wait for macro conditions to improve:

The only place to invest right now is in early-stage private tech startups. Early-stage valuations are reasonable. Founders are focusing on their unit economics. They are limiting cash burn to not have to go to market for at least two years. Startups face lower customer acquisition costs and much less competition. While exits will be delayed and exit multiples lower than in the past few years, this should be compensated by lower entry prices and the fact that winners will win their entire category.

The cockroach approach

Unicorns may have been the sexy thing to build in the last decade. But the current challenging market calls for a different kind of animal—cockroaches. We know; cockroaches may not be sexy, but as Nick Martin puts it:

Cockroaches are scrappy; doing everything they can to stay alive. The current funding landscape calls for this kind of grit and determination. To survive this uncertain future, startups would do well to take a step back to basics. Prioritise low cost entry points that get you closer to faster revenue over the shiny platforms and look to sustainable business models that are anchored in more realistic unit economics.

Be frugal

Being cockroachy also means reducing your burn to the minimun necessary—whatever “necessary” means to your case. For some, it's necessary to grow fast in order to create momentum. For others, surviving means reaching a break even point. However you define it, be realistic. If a CEO needs to fire employees in order to survive, it's no use doing it gradually. This will only demotivate employees who think they may be next. An ounce of prevention is worth a pound of cure.

Many top-tier VCs are recommending their startups raising capital to target 30-48 months of runway. This is because they expect market headwinds to persist well into 2024.

Do not over-optimize for valuation

Founders understandably want to optimize for valuation. Unfortunately, they often forget that even if they can get away with high valuations, there will come a time when investors downstream will ask for stricter justification of future valuations. This puts a clock on founders to materially expand the actual value of their business in a short period of time. This is the case today, when the gap between demand for intermediate phases of venture (series A, B and C) significantly exceeds available investment.

So, if you're presented terms by a reputable investor, do not scorn it. Try optimizing for the quality of the investors on your cap table, rather than the valuation.

And if you raised a round at a ridiculously high valuation in 2021, but you haven't delivered the expected value, don't drink the koolaid. If you're raising funds today, you may need to adjust your valuation accordingly.