We looked at ARR, or Annual Recurring Revenue, earlier. Let’s talk about MRR, or Monthly Recurring Revenue now, which is perhaps of even more interest to investors than ARR.

What is MRR?

MRR is a metric that represents the revenue you expect every month from your paying customers. It neatly summarizes your recurring revenues into a single average number. It is a vital metric for SaaS-related businesses especially indicating consistency and predictability of revenue growth and customer stickiness.

Types of MRR

For analysis, MRR is broken down into different types that show how MRR is moving. These types are usually:

- New MRR: MRR earned from new customers

- Expansion MRR: Additional MRR earned from existing customers

- Contraction MRR: MRR lost reasons other than churn (e.g., downgrades)

- Churned MRR: MRR lost from cancellation or non-renewal

- Net or Growth MRR = New MRR + Expansion MRR – Churned MRR

- Cohort MRR: Bunch MRR by product, pricing plan, region, tenure, date added, or another parameter relevant to your business.

Calculating MRR

The easiest way to calculate your MRR is to base it on your ARPU, or average revenue per user.

Monthly ARPU=Total subscription revenue/Avg. number of users

Both subscription revenue and the average number of users will be for the month. Hence, the total subscription value of each customer will be divided by the tenure to arrive at monthly revenue for that customer. Add up each such customer, and you have your total subscription revenue for the month.

MRR=Monthly ARPU ×Total number of subscription customers

A few nuances and caveats in MRR calculation:

- Use only recurring subscription revenues. One-off revenues are to be excluded

- Subscriptions received in advance (e.g., Quarterly/semi-annual/annual advance payments) should be spaced out over the subscription period. Remember, this is not a cash flow calculation – you are calculating MRR to measure your growth momentum.

- Exclude trial subscriptions, both in terms of your number of users and the revenue expected from them.

- Net off discounts; don’t base MRR on your rack rate but your actual realization. This means reducing revenue by the value of coupons, discounts, free add-ons, etc.

- ARR gets included in MRR; MRR doesn’t necessarily get included in ARR – seems obvious, but needs to be said.

What is it used for?

The thing about ARR is that it is relevant only for startups with long-drawn and multi-year contracts. This makes MRR more relevant for a more significant proportion of startups and thus for more investors. The utility is similar to what I highlighted in ARR – your subscriptions or contracts are usually not of a similar tenure, nor would they run concurrently. MRR helps to smoothen out into a single number all of the following:

- Subscriptions/contracts with dissimilar values

- Subscriptions/ contracts with dissimilar tenures

- Subscriptions/contracts that get added on through the year (New MRR)

- Extensions to subscriptions/contracts (New MRR)

- Add-ons or upgrades to subscriptions/contracts (Expansion MRR)

- Downgrades to subscriptions/contracts (Contraction MRR)

Financial forecasts and setting goals:

This comprehensive coverage helps to estimate the recurring revenue in the coming months and, more importantly, an analysis of the trend in MRR over time. MRR is a crucial input for your revenue forecasting. A consistent growth pattern in this trend is what investors are looking for to back your (usually exponential!) revenue growth forecasts. Conversely, the trend will also indicate the kind of churn your startup is subject to.

Determining compensation:

Besides investor interest in MRR, startups are increasingly using MRR to determine sales team compensation. It is also a good idea to use the MRR metric as a KPI for your product team – a good product sells itself while a poor product will not sell or suffer high churn, both of which show up in MRR. Robust growth in MRR is a sign of a product team that knows its job and is doing it well.

Analysis:

Analysis of Cohort MRR can give you insights into aspects that are doing well. For example, suppose you have a date-based cohort, and you see it doing oddly well on retention or upselling. In that case, you can correlate it with marketing campaigns or pricing plans offered in that cohort, all else being equal. Likewise, cohorts sorted by support teams can yield insights into how differences in product or customer support impact MRR.

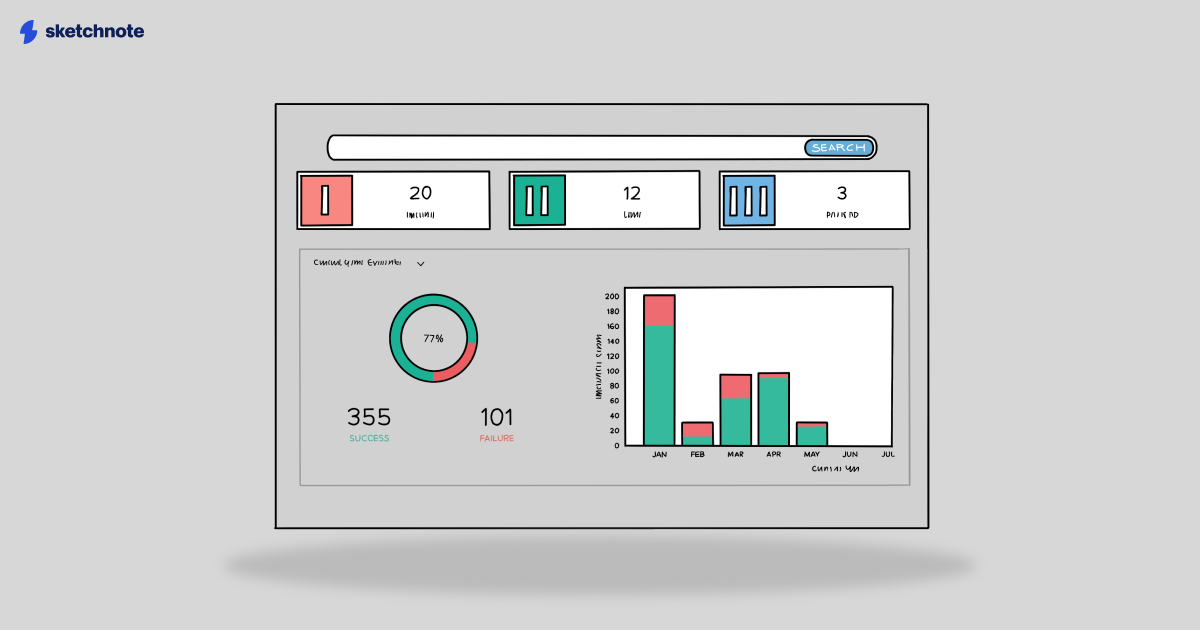

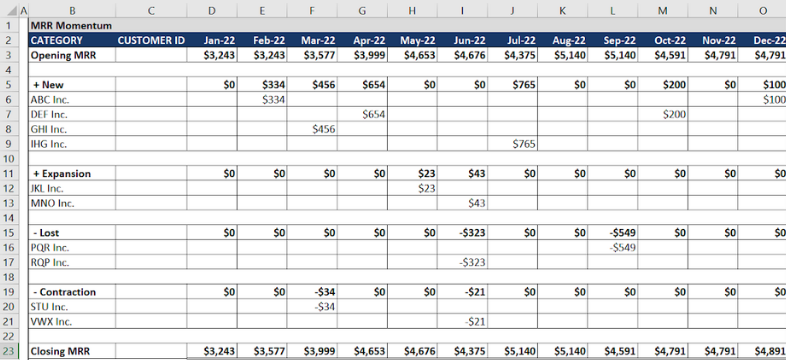

MRR dashboard

Your MRR dashboard outlines each month’s MRR calculations – what you started with, what got added, what got dropped, and what you are left with at the end of the month (which becomes the start point for the next month). This is what a typical dashboard might look like:

Any analysis of MRR should ideally be based on trend lines or moving averages rather than focusing on any rise or fall in a particular month.

Growing MRR

Grow revenue to grow MRR, simple, right?

- New customers: your MRR analysis should yield insights into product features, regions, customer behavior, and more, which in turn should help you figure out how to target more customers.

- Price higher: Figure out at what point you can charge customers more to grow revenues.

- Upselling: Assuming you have more premium products or product features, upselling and cross-selling are objectives you should be thinking about all the time. Why? Because it is always easier to sell more to an existing customer who knows you than to get out there and find new customers.

- Nix freemium: Free trials and freemium are strategies for untested products. Stop giving away stuff once you have an established product, and momentum or ‘word of mouth’ has kicked in.

The final word

Quite like ARR, MRR is a vital revenue for SaaS businesses because the latter numbers are often more revealing than the former. It shows consistency, predictability, and stickiness, all at once.

MRR is usually calculated based on your ARPU, and only recurring subscriptions are to be taken into consideration.

Make sure to have your MRR numbers in place when you approach new or existing investors, because not just your financial forecast, but even your remuneration to your team is dependent on these numbers, or the projection of them. Good luck!